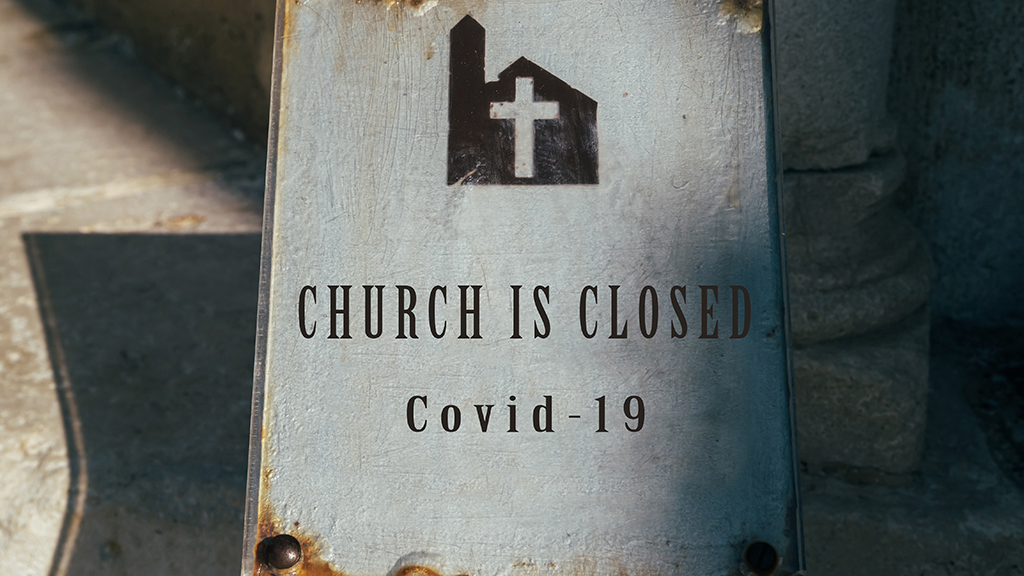

Don’t let your insurance get cancelled by Covid

Many churches do not realise their insurance claims have been potentially invalidated by the pandemic.

So says Russell Hickman, of Access Insurance, who points out how, with church premises not checked as regularly, even a leaky roof can fall foul of the conditions.

‘Few risk management or business continuity plans foresaw the possibility of closing premises for extended periods,’ says Russell, an advisor to churches for the Surrey-based company. ‘Charities in particular have faced the challenge of moving staff and volunteers to remote working.’

Income has also taken a huge hit.

‘Those who put gifts on a plate each Sunday were no longer doing so, but additional investment has been needed to put services online,’ said Russell.

The majority of standard policies exclude any cover for Covid-19 related expenses or lost income. However the Financial Conduct Authority (FCA) has tested some policies in court to obtain a ruling on whether any cover exists and at least one church insurer is considering Covid-19 claims following a recent court ruling.

The case is based around extensions to the business interruption cover which traditionally covered losses stemming from damage at the premises insured, resulting in extra costs being incurred or loss of income as activity ceased. Over the years insurers have added non-damage extensions to the wordings to cover situations where, for example, the insured party could not access the premises for a variety of reasons, some of which included an outbreak of an infectious disease in the locality. Some insurers clearly define which diseases they cover, others are more ambiguous.

The FCA argued that the pandemic lockdown orders and the reluctance of people to continue in economic activity are ‘one indivisible cause’. The court passed a judgement, ruling that some policies did cover losses arising from the pandemic. A number of insurers appealed, but the Supreme Court ruled in favour of policyholders, ordering some insurers with ambiguous wordings to pay claims.

The ruling is unlikely to affect many non-profit organisations as several of the large specialist charity insurers had clear wordings, and the courts ruled they were not liable for Covid-19 business interruption losses.

Some charities were aware of the extent and limitations of their cover but a significant number believed they would be covered for Covid-19 related losses and expenses under their business interruption cover. While it was possible to purchase standalone ‘pandemic insurance’ before Covid-19, these policies were prohibitively expensive for most organisations and very few of these policies exist – cover for Wimbledon Tennis is one such example.

In addition, there is usually limited cover under business interruption policies for losses which do not arise from a defined peril (insured risk) like ‘damage to property’, i.e. having to use another office following fire damage to your own premises.

Aside from any contractual obligations, a group of insurers have donated over £80 million to a Covid-19 Support Fund, designed to assist community-based charities and those supporting the most vulnerable in society. The fund is being administered by a network of larger funding charities including the National Emergencies Trust. Insurers have generally been willing to be more flexible than normal with contract terms and obligations because of the pandemic and lockdowns/ tier system. Many insurers have waived or relaxed stringent policy conditions which would normally apply to buildings which become unoccupied for example.

Insurers are taking different stances on liability cover as policies are renewed, with some adding blanket Covid-19 exclusions and others making no amendments. In the main, larger charities are reviewing costs and seeking leaner insurance programmes which provide the essential cover they need, without some of the optional covers they might have opted to purchase before the pandemic. Key information which determines the cost of a policy should be shared with insurers as soon as possible. This includes projected income and wage roll figures and any change in activities.

Having a remote workforce means charities will want to review the insurance they have for office equipment, possibly widening the cover to include risks such as theft of laptops from employees’ homes. Similarly, if their insurance covers the running of the events and the hiring in of equipment. they will want to review whether the event will proceed and whether cover is required.

Access Insurance works with over 15,000 churches and charities to understand their unique risks and build specific policies – so organisations only pay for the cover they need. Access is willing to offer advice to churches and charities struggling to understand their position and they are invited to contact Russell Hickman for advice and support.

Access are exhibiting at CRE National (12-14 October 2021, Sandown Park, Surrey) and CRE South West (23-24 Feb 2022, Westpoint, Exeter)

Our next exhibitions

CRE South West 2022

23-24 February 2022

Westpoint, Exeter

CRE National 2021

12-14 October 2021

Sandown Park, Surrey

CRE News

Your new 60-page products and services guide. Nothing beats reading it!

Dave Hall author

Christian Resources Exhibition

1 and 2 Ellison’s Cottages

Crank Road

St Helens

Merseyside

WA11 7RQ

Christian Resources Exhibition is a limited company Reg No. 02549188

About the author